fidelity tax-free bond fund by state

UK-domiciled funds report after-tax dividends. Alert The Lord Abbett Sustainable Municipal Bond Fund is now available.

What Happened with UBER.

. The Lord Abbett Bond Debenture Fund seeks to deliver high current income and long-term growth of capital. Additional risk information for this product may be found in the prospectus or other product. Disney Will Be Tested.

Fidelity Ohio Municipal Income Fund FOHFX 3. SEE THE FULL RANKINGS LIST. The tax-free status can produce a tax-effective yield that can beat other bonds.

03 McCormick Co IncMD. IBMK is one of several defined. Before buying a fund read its prospectus to determine whether interest from the fund is expected to be subject to federal state or local taxes.

Earnings Any earnings grow federal income tax deferred. Order lit 0 track funds 0 Tracked Funds. Partial and Full Calls.

Rowe Price Maryland Short-Term Tax-Free Bond Fund since 12311996 Show. Investors seeking to preserve capital for the next year while receiving a small tax-free bond payment might consider this fund. PepsiCo Option Traders Watching Bottom Line.

The tax cost listed for municipal bonds is the hidden cost the amount an investor loses in returns to avoid. Minimum Initial Contributions None. A bond which has a 6 yield loses 132 to taxes in a 22 tax bracket whether that is the current yield on a short-term bond or a long-term bond.

0000 -03 Topaz Solar Farms LLC. Not only Koushis the confusion over tax-saving and tax-free bonds has left many taxpayers who availed tax benefits by investing in Long-Term Infrastructure Bonds issued by IDFC REC IIFCL. Municipal bonds often offer lower yields than other bonds.

Franklin Ohio Tax-Free Inc Fd FTOIX. Although VCITX is a state municipal bond fund the income from the fund is free of tax at the federal level and at the state level if you live in the state where the municipal bonds are issued. Generally municipal securities are not appropriate for tax-advantaged accounts such as IRAs and 401ks.

Interest income generated by municipal bond funds is generally not subject to federal taxes and may also be exempt from state and local taxes if the bonds held by the fund were issued by the state in which you live. High Contribution Limit 553098 per. Begin by selecting funds to create a personalized watch list.

Can Coca-Cola Keep Up the Trend. The formula is used to calculate the tax-free yield youd need to earn in order to get the same after-tax return adjusted for your federal income tax bracket. Fidelity BondCD Redemption Alerts is a service designed to provide Fidelity customers with information about key changes to the status of their bonds via either paper or e-mail.

As of 12052015 Calibrated Large Cap Value Fund A Price. You have 0 funds on your mutual fund watch list. Non-UK-domiciled funds report gross dividends.

BondCD Redemption Alerts consist of the following events. In prior years you might have gone all out on the roses Teddy Bears chocolate jewelry a fancy dinner those little candy hearts but that was before you decided to make financial. Income from these funds is usually subject to state and local income taxes.

Fund returns are based upon Nav to Nav or Bid to Bid income reinvested basis. A bond funds total return measures its overall gain or loss over a specific period of time. SEC Proposes New Protections for Private Fund Investors.

Fidelity Tax-Free Bond FTABX FTABX holds municipal bonds that are exempt from federal income tax. Calibrated Large Cap Value Fund A Price. Customers can enroll in the Alerts service by going to the Research tab and selecting Alerts.

0000 -03 TopBuild Corp. Municipal bond funds dont always offer the highest yields. Most of the holdings are bonds issued by state and city governments in the US.

Interest for bond funds is based on historical rates not current rates because the numbers are easy to measure. Withdrawals Qualified withdrawals for education expenses are federal income tax free and exempt from New Hampshire interest and dividends tax. The management fee is a low 018.

Start of Performance Disclaimer Fund prices are updated every weekday after the close of trading and before 11 pm. Performance figures are presented in British Pounds GBP. 03 Laredo Petroleum Inc.

But when you live in a state with high taxes the state and federal combined tax-effective yield can be significant. View prospectus and more. 03 ROBLOX Corp.

Benefits of the Fidelity Advisor 529 Plan include. The tax-equivalent yield will be higher for investors in higher tax brackets.

Which Bond Funds Are Most Exposed To Evergrande Morningstar

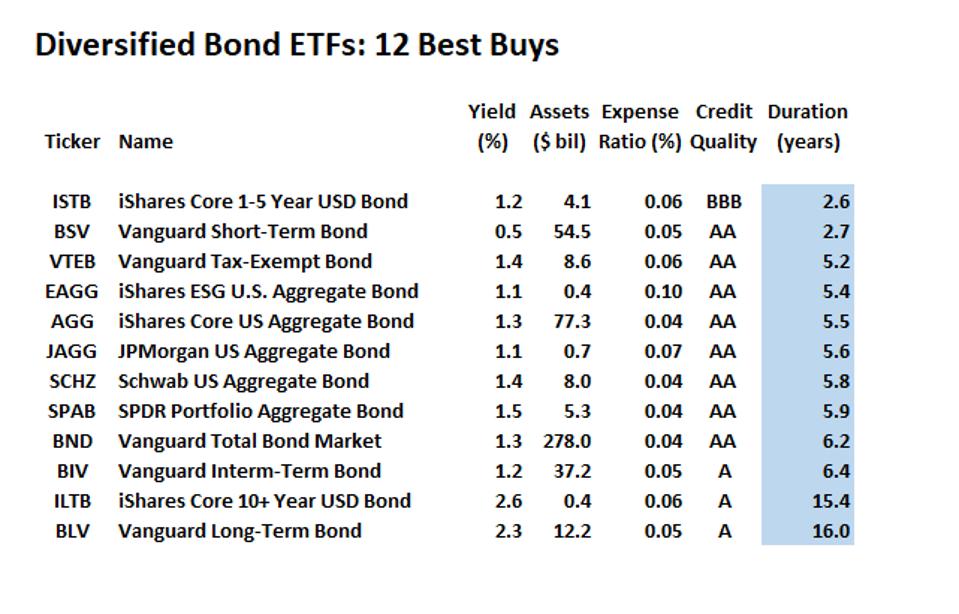

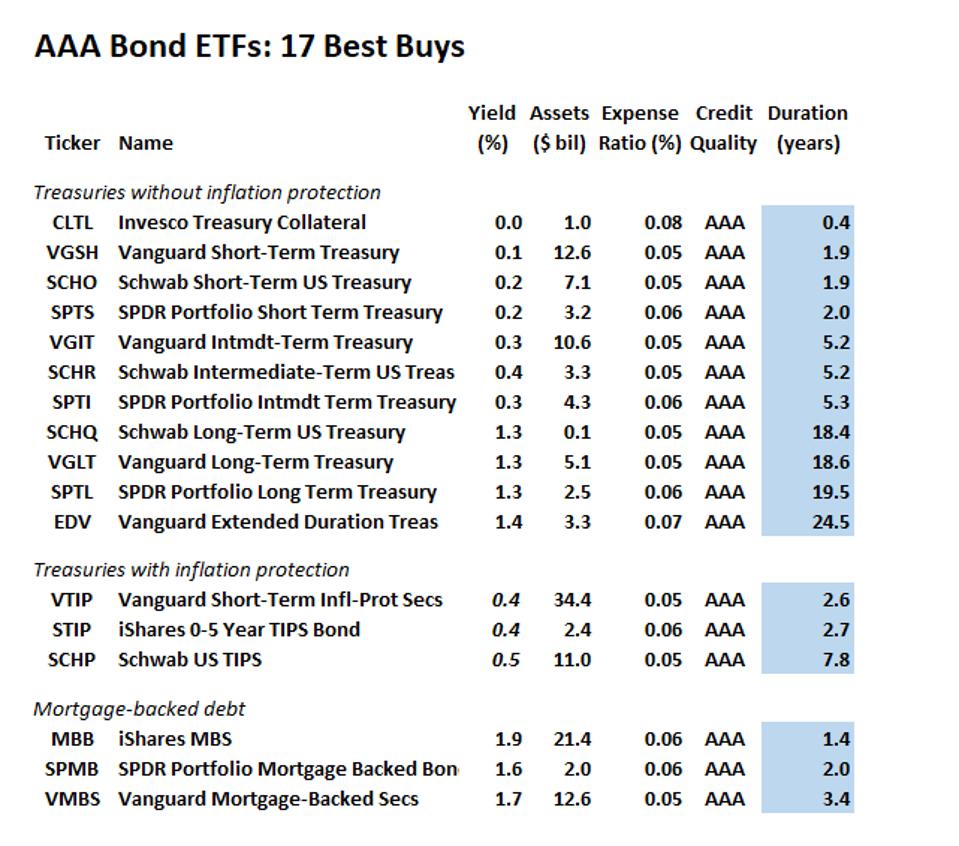

Guide To Investment Grade Bond Funds Best Buys

Which Bond Funds Are Most Exposed To Evergrande Morningstar

U S Fund Flow Records Fell In 2020 Morningstar Bond Funds Corporate Bonds Fund

Guide To Investment Grade Bond Funds Best Buys

Share Buybacks Companies Buying Their Own Shares Fidelity Corporate Bonds Inflection Point Financial Engineering